The Internal Revenue Service (IRS) is preparing to lay off thousands of probationary employees during the peak of the 2025 tax filing season. This significant reduction in workforce is expected to impact the processing times of tax returns and the issuance of refunds for millions of taxpayers.

Scope of the Layoffs

Reports indicate that up to 15,000 workers, primarily those in probationary status, are slated for dismissal. These employees often occupy roles critical to tax return processing and customer service, including positions in taxpayer response units and phone centers. The layoffs are anticipated to exacerbate existing challenges within the IRS, potentially leading to delays in refund processing and reduced assistance for taxpayers seeking support during the filing season.

Estimated 2025 IRS Income Tax Return Chart

| If the IRS Accepts an E-Filed Return By: | Then Direct Deposit refund may be received as early as 10 days after e-file accepted. (E-filed, but paper check mailed apx. 1 week after that): |

|---|---|

| The IRS started accepting returns on Jan. 27, 2025. | |

| Jan. 27, 2025 | Feb. 7 (Feb. 14)** |

| Feb. 3 | Feb. 14 (Feb. 21)** |

| Feb. 10 | Feb. 21 (Feb. 28)** |

| Feb. 17 | Feb. 28 (Mar. 7)** |

| Feb. 24 | Mar. 7 (Mar. 14) |

| Mar. 3 | Mar. 14 (Mar. 21) |

| Mar. 10 | Mar. 21 (Mar. 28) |

| Mar. 17 | Mar. 28 (Apr. 4) |

| Mar. 24*** | Apr. 4 (Apr. 11)*** |

| Mar. 31*** | Apr. 11 (Apr. 18)*** |

| Apr. 7 *** | Apr. 18 (Apr. 25)*** |

| Apr. 14*** | Apr. 25 (May 2)*** |

** = Returns with EITC or CTC may have refunds delayed until March to verify credits.

*** = Filing during peak season (late March through April 15) can result in slightly longer waits.

| IRS Accepts Return By: | Direct Deposit Sent (Or Paper Check Mailed one week later) |

|---|---|

| Apr. 21 | May 2 (May 9) |

| Apr. 28 | May 9 (May 16) |

| May 5 | May 16 (May 23) |

| May 12 | May 23 (May 30) |

| May 19 | May 30 (June 6) |

Potential Impact on Taxpayers

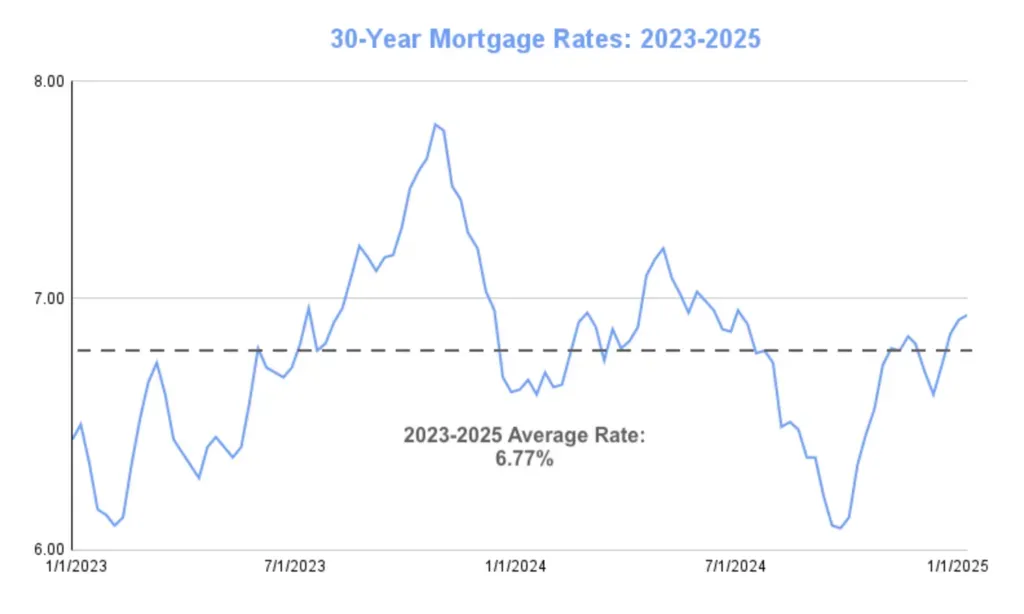

Historically, the IRS has aimed to issue refunds within 21 days for electronically filed returns and up to eight weeks for paper submissions. However, the impending staff reductions may extend these timelines. Taxpayers claiming credits such as the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) might experience more pronounced delays, as these require additional verification processes.

To mitigate potential delays, the IRS advises taxpayers to:

- File Early: Submitting tax returns promptly can help expedite processing.

- Opt for Electronic Filing: E-filing reduces processing time compared to paper returns.

- Choose Direct Deposit: Selecting direct deposit for refunds can accelerate receipt of funds.

Accessing Refund Status

Taxpayers can monitor the status of their refunds using the IRS's "Where's My Refund?" tool, available on the official website. This resource provides real-time updates and requires the taxpayer's Social Security number, filing status, and exact refund amount for access.

Broader Implications

The layoffs coincide with other significant changes within the IRS, including initiatives led by the Department of Government Efficiency (DOGE) to access sensitive taxpayer data. These developments have raised concerns about the agency's capacity to effectively manage tax administration and safeguard taxpayer information during a period of reduced staffing and increased scrutiny.

As the situation evolves, taxpayers are encouraged to stay informed through official IRS communications and consider consulting tax professionals to navigate the complexities of the current filing season.